Understanding Collapsed Stock: Strategies and Impacts on Global Financial Markets

Explore the intricacies of collapsed stock, its causes, and preventive strategies. Learn from historical examples and recent studies about how internal gove……

Definition and General Overview

The term "collapsed stock" defines a dramatic and substantial drop in the value of a company's shares, which can occur abruptly and is often influenced by a mix of internal and external factors. This phenomenon is usually triggered by circumstances such as market instability, adverse corporate news, significant economic shifts, or unforeseen global events. The implications of a stock collapse are wide-ranging, affecting investors, the company’s health, and often the broader economy.

Understanding the mechanics behind stock collapses is crucial for investors, corporate managers, and policymakers. It assists in preparing for potential risks and implementing strategies to mitigate such occurrences in the future. Stock collapses carry significant financial consequences, and their understanding helps in crafting more resilient financial markets.

Importance of Understanding Stock Collapses

Grasping the concept of collapsed stocks is essential not only for direct participants, such as investors and financial professionals, but also for the general public. Knowledge of how stocks can collapse guides better investment decisions, enhances risk management strategies, and fosters a more robust economic environment.

Awareness of the factors leading to stock collapses can help in recognizing early warning signs and potentially averting financial disasters. Additionally, in-depth understanding aids governmental and regulatory bodies in forming necessary policies and regulations to stabilize financial markets and protect the interests of the public and investors alike.

In a broader sense, insights into collapsed stocks enhance financial literacy among individuals, leading to more informed decisions regarding investments and personal finance management. The dynamics of stock collapses, although complex, offer valuable lessons on the interconnected nature of global markets and the indirect effects market behaviors can have on fundamental economic stability.

Global Impact of Market Instabilities: The 2020 COVID-19 Case Study

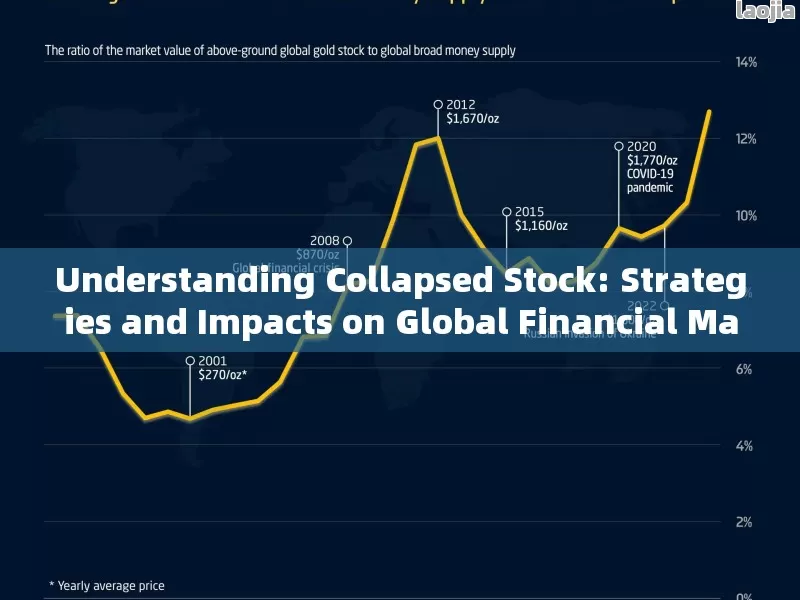

The COVID-19 pandemic in 2020 provided a distinct example of how global crises can precipitate widespread stock market instabilities. During this period, markets across the world, starting with China, underwent significant strain leading to instances of collapsed stock values. The phenomenon was not isolated but showed statistical evidence of an international spill-over effect, whereby instability in one country's stock market had cascading impacts on others, reflecting the interconnectedness of global financial markets.

This widespread market turbulence was marked by periods of mildly explosive dynamics before significant collapses occurred. The patterns observed during this time underscore the crucial impact that external, uncontrollable socio-economic elements can have on stock markets. This understanding is vital for developing strategies that can mitigate similar impacts in the future and safeguard economies against possible crashes.

Patterns and Identification of Explosive Stock Market Dynamics

Identifying patterns that precede market collapses is essential for instituting preventive measures. Studies during various financial crises, including the 2020 pandemic, revealed that certain mildly explosive dynamics often foreshadow severe market drawbacks. These dynamics are characterized by rapid stock value fluctuations, increased trading volumes, and heightened market sensitivity to real-time economic news.

Tools and models that can predict these explosive trends are invaluable in the financial sector. With advanced analytical tools, experts can detect abnormal market behaviors early enough to address potential risks effectively. For instance, machine learning algorithms can analyze vast datasets rapidly and detect anomalies that signify potential market collapses.

Properly recognizing and understanding these patterns not only helps in short-term financial safeguarding but also improves long-term market stability. Effective identification leads to robust risk management strategies that prepare markets and investors for sudden economic shocks, thereby preserving investments and overall economic health.

In summary, the dynamics of stock market collapses are complex and influenced by a myriad of factors ranging from global economic crises to internal market mechanisms. The COVID-19 pandemic has highlighted the need for more sophisticated tools to monitor market activities and anticipate future instabilities. Effective strategies and modern technologies should be employed extensively to detect early signs of potential collapses, ensuring wider economic security and stability.

When examining the reasons behind the fluctuations and potential collapses of stock prices, it is crucial to consider the dynamics of information flow and managerial decision-making within corporations. Understanding these aspects not only helps in foreseeing potential risks but also in formulating strategies to mitigate such crises.

The Role of Managerial Rationality and Information Concealment

Managerial decisions play a pivotal role in the stability and integrity of stock prices. The concept of managerial rationality implies that leaders are expected to make decisions that best serve the interests of their stakeholders. However, bounded rationality — the idea that decision-making is limited by the information available, cognitive limitations, and finite time — can lead to suboptimal outcomes. Managers, influenced by their perceived rationality, might withhold negative information from stakeholders to maintain stock prices or avoid panic.

This concealment can backfire severely. When the withheld information inevitably surfaces, it can lead to a sudden loss of investor confidence and a sharp decline in stock prices, termed as 'collapsed stock'. The delay in the dissemination of important company news or financial reports builds up uncertainty and speculative behavior among investors, which often exacerbates the impact when the truth emerges.

Principal-Agent Problem and Its Effects on Stock Prices

The principal-agent problem is a theory explaining the issues that arise when one person or group (the agent), such as a manager or executive, is able to make decisions on behalf of another person or group (the principal), such as the shareholders. In the context of stocks, this problem manifests when managers' personal goals conflict with the goals of the shareholders.

Managers may engage in risky endeavors or investment strategies aiming for personal short-term gains or bonuses at the expense of long-term shareholder value. They might also present overly optimistic views of the company's future or obfuscate the full extent of risks involved. This misalignment can lead to decisions that, while beneficial in the short term for certain executives, might lead to stock price crashes when the true state of affairs becomes public knowledge.

These factors highlight the critical importance of transparency and alignment of interests between managers and shareholders to minimize the risk of stock price collapses. It becomes apparent that for the sustainability of stock prices, corporations must encourage practices that enhance transparent reporting and ethical managerial conduct.

In examining the causes of SPCR, one must appreciate the complexity of information dynamics and managerial strategies within corporations. These elements significantly influence the degree of stock price stability and risk, thus necessitating careful consideration by investors, analysts, and policymakers alike.

An important yet often overlooked facet of corporate governance that impacts stock price stability is the concept of Corporate Social Responsibility (CSR) decoupling. CSR decoupling happens when there is a noticeable gap between what companies disclose about their CSR initiatives and their actual CSR activities. This discrepancy can have significant implications on stock price stability, affecting investor confidence and market perceptions.

Understanding CSR Decoupling

CSR decoupling refers to the inconsistency that occurs when a firm's CSR disclosures do not accurately reflect their actual CSR engagements. This phenomenon typically arises when companies attempt to paint a socially responsible image to boost their public persona, all while engaging in practices that might contradict this image. The motivation for such behavior often stems from the desire to enhance market value or divert attention from less favorable operations. However, the implications of such actions can be quite detrimental not just to the stock price stability but also to the overall credibility of the company.

Empirical Evidence on CSR Decoupling and Stock Crash Risk

Recent empirical studies have illuminated the strong correlation between CSR decoupling and the risk of stock price crashes. For instance, research has demonstrated that every 1 percent increase in CSR decoupling can spike the crash risk by approximately 2.09%. These findings are substantial, pinpointing how significant the alignment between actual CSR activities and disclosed CSR practices is to maintaining stock price stability.

The risk associated with CSR decoupling is particularly pronounced during crises or when the market is already volatile. Investors and stakeholders, increasingly aware of CSR practices, react sharply to discrepancies between reported and actual CSR activities, often leading to rapid declines in stock prices when such discrepancies are uncovered.

Effect of Information Asymmetry on CSR Strategies and Stock Prices

The traditional view of CSR involves the adoption of strategies that not only advance corporate objectives but also contribute positively to societal goals. However, the impact of information asymmetry — where one party possesses more or better information than the other — complicates this scenario. In environments with high information asymmetry, the misunderstandings between corporate intentions and stakeholder perceptions regarding CSR can be significant.

This asymmetry leads to a heightened risk of CSR decoupling, as companies might not feel the immediate pressure to align their disclosures tightly with their actual CSR activities. The resultant effect on stock prices can be quite dramatic. A higher level of agency risk, where managers prioritize personal or immediate corporate gains over long-term shareholder value, is also seen to exacerbate the effects of CSR decoupling on stock crash risks.

In conclusion, the stability of stock prices can be greatly influenced by the degree of consistency in CSR practices. Companies that ensure a strong alignment between their CSR reports and actual CSR initiatives tend to enjoy more stable stock prices, whereas those with significant CSR decoupling face a heightened risk of stock price collapses. This dynamic underscores the importance of transparency and honesty in corporate disclosures, not only as a legal or ethical requirement but as a strategic imperative to maintain investor trust and market stability.

Understanding historical stock market crashes provides valuable insights that can help investors and market analysts predict and potentially mitigate future financial downturns. This chapter delves into some of the most devastating stock market crashes in history, exploring their causes, impacts, and the lessons learned.

In-depth Analysis of the 1929 U.S. Stock Market Crash

The 1929 U.S. stock market crash, often referred to as Black Tuesday, remains one of the most notorious financial downturns in history. This crash marked the beginning of the Great Depression, a period of worldwide economic hardship. Key factors contributing to the crash included excessive stock market speculation during the 1920s, where the use of margin buying became extensively common.

The speculation bubble burst when investors started to realize the stocks were overpriced, leading to a massive sell-off. A lack of proper regulatory frameworks and the inability of the stock market to handle such heavy volumes of trades exacerbated the situation. The aftermath saw a catastrophic decline in stock prices, extensive economic damage, and profound societal impacts, emphasizing the need for better financial regulations and market oversight.

Lessons from the 1987 Stock Market Collapse

Another significant event in the history of financial markets is the 1987 stock market collapse, famously known as Black Monday. On October 19, 1987, stock markets around the world crashed, shedding a huge value in a very short time. Unlike the crash of 1929, this collapse was influenced by technological advancements and program trading.

Financial markets had just begun integrating automated systems, which, while designed to make trading more efficient, inadvertently contributed to the crash by accelerating sell-offs through program-driven trading. The 1987 crash highlighted the potential dangers of technology in trading systems and led to the implementation of circuit breakers to temporarily halt trading in instances of unusually high market declines.

Other Notable Historical Stock Market Crashes and Their Causes

Throughout history, other stock market crashes have also made their marks, such as the Dot-com Bubble burst in 2000, and the Financial Crisis of 2008. Each of these events shared common elements including high levels of speculative investment and inadequate regulatory oversight. For instance, the Dot-com Bubble was characterized by excessive investment in internet-based companies, which, despite their lack of profitable business models, were wildly overvalued. The burst of this bubble led to massive losses and highlighted the dangers of speculative excess.

The 2008 financial crisis, triggered by the collapse of the housing market and high-risk mortgage securities, pointed to deeper issues in credit markets and financial regulatory practices. This led to worldwide economic distress and prompted significant reforms in financial risk management and regulatory practices.

Each of these historical crashes teaches the critical importance of oversight, the dangers of speculative excess, and the need for continuous adaptation of regulatory frameworks to keep pace with evolving market practices. By studying these events, modern economies aim to develop mechanisms to prevent or at least mitigate the effects of similar future downturns.

In conclusion, examining past stock market crashes is crucial for understanding the dynamics of financial downturns. Each event provides unique lessons that can help in structuring more resilient financial systems and prevent future collapses. The historical perspective not only educates new investors about the potential risks but also serves as a guide for policymakers to enhance financial regulations.

Preventing stock market collapses and mitigating their effects requires strategic measures and robust policies. This chapter outlines key strategies that can strengthen financial markets and reduce the likelihood of severe stock price declines.

Improving Internal Governance Structures

Enhancing the governance structures within corporations is crucial for maintaining stock price stability. Effective governance involves clear roles and responsibilities for management and boards, strong oversight, and transparent practices that promote accountability.

Transparency and Accountability

Encouraging transparency in corporate actions and financial reporting can prevent misunderstandings and mistrust among investors. Periodic and accurate disclosures of financial health, risk factors, and management decisions help investors make informed decisions, reducing the probability of panic-induced sell-offs.

Enhancing Board Oversight

Strong board oversight can mediate risky management behaviors by ensuring that strategic decisions align with long-term shareholder interests and comply with regulatory standards. Boards should also be empowered to challenge and veto management decisions that could jeopardize the company's stability.

Implementing Effective Risk Management

Adopting comprehensive risk management frameworks can safeguard against unforeseeable market dynamics. These frameworks should include stress testing, scenario analysis, and continuous monitoring of both external and internal risks. By understanding potential vulnerabilities, companies can create responsive strategies that mitigate risks before they lead to stock collapses.

The Role of Market Competition and Access in Preventing Collapses

Increasing market competition and access plays a significant role in stabilizing stock prices by reducing monopolistic practices and encouraging a more dynamic market environment.

Fostering Competition

Regulations that support a level playing field for new entrants can stimulate innovation and efficiency within industries. Competition compels companies to maintain healthy business practices and financial standards to stay relevant and appealing to investors.

Expanding Market Access

Improving access to financial markets for a wider range of companies ensures that capital is not overly concentrated in a few large entities, reducing systemic risk. Enhanced accessibility for small and medium enterprises to stock markets can lead to a more diversified and resilient economic environment.

Regulatory Reforms

Government and regulatory bodies can prevent potential crashes by continually revising and implementing policies that adapt to changing market conditions. This involves eliminating loopholes that allow risky financial practices and enhancing surveillance mechanisms to detect early signs of market distress.

In sum, preventing stock collapses and mitigating their potentially disastrous impacts require a multifaceted approach involving improved corporate governance, enhanced market competition, and adaptive regulatory reforms. By addressing these areas, stakeholders can safeguard against extreme volatility and maintain a healthier financial market ecosystem.

Summary of Key Points

The concept of a collapsed stock, characterized by a sudden and severe drop in stock prices, poses significant threats to investors and the wider economy. This exploration has addressed various dynamics and factors contributing to stock collapses, including global market instabilities, the role of corporate social responsibility (CSR) decoupling, and agency risks. Moreover, historical analyses have provided valuable lessons from past market crashes, reinforcing the importance of robust stock market governance and responsible corporate behavior.

Understanding the causes and implications of stock collapses is crucial. From the transmission of instabilities across global markets, notably during the COVID-19 pandemic, to issues surrounding managerial discretion in information disclosure and the alignment of CSR activities with stated commitments, the factors contributing to stock market collapses are complex and multifaceted.

Moreover, empirical evidence suggests that each percent increase in CSR decoupling can significantly elevate the risk of a stock market crash, indicating that integrity in corporate disclosures and practices plays a critical role in maintaining investor confidence and stock stability. Additionally, historical events such as the 1929 and 1987 crashes have shown the profound and enduring effects of market downturns, emphasizing the need for vigilant and proactive market regulation.

Future Outlook on Stock Market Stability

Looking ahead, the stability of stock markets will likely continue to be tested by varying economic conditions, corporate behaviors, and global events. However, the lessons drawn from historical precedents and recent research highlight several pathways to bolster market resilience. Improving internal governance structures within companies, fostering competitive market environments, and regulating market access are pivotal strategies.

Proactive efforts should focus on enhancing transparency and accountability in corporate governance, ensuring that management decisions are in the best interests of shareholders and align with ethical standards. Furthermore, by supporting policies that encourage competition and fair market access, the risk of monopolistic practices leading to market imbalances can be substantially reduced.

In conclusion, while the phenomenon of collapsed stocks is inevitably linked with the nature of financial markets, comprehensive strategies to mitigate these risks can reduce the frequency and severity of such events. By fostering a regulatory environment that promotes transparency, accountability, and fairness, the potential for future stock market collapses can be more effectively managed, thereby safeguarding the financial ecosystem and protecting investor interests.

Tactical Gear Shop Essentials: Professional Equipment Selection & Global Market Insights

How to Achieve Immaculate Spaces: Science-Backed Cleaning & Habit Strategies

Unlock the Benefits of Foldable Arm Braces for Enhanced Mobility & Stability

Explore Aimpoint and Ampoint: Innovations in Optical Sights and Strategic Logistics

Navigating the Risks of Collapsable Stock: Strategies and Insights

AR Stock Folding Adapters: Maximize Tactical Mobility & Recoil Control in Compact Firearm Builds

Unlocking the Power of AR Fold: Exploring Augmented Reality and Cryptocurrency Integration